NEWS & EVENTS

Over the past few years, Southeast Asia’s data centre industry has transformed rapidly. Singapore initially set the benchmark, supported by business-friendly policies, political stability, and robust infrastructure. However, Singapore’s moratorium became a catalyst, prompting investors and operators to seek opportunities across neighbouring markets.

Investment momentum first shifted to Jakarta, then expanded to Johor Bahru and Kuala Lumpur as alternative data centre hubs gained traction. Today, attention is turning to Bangkok. Momentum is accelerating, and Thailand is emerging as Southeast Asia’s next breakout data centre market.

Bangkok’s Data Centre Market: A Rising Regional Player

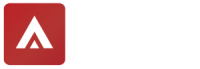

Bangkok has become the second-largest data centre market in Southeast Asia by total IT capacity, trailing only Malaysia. With total planned capacity reaching 2,587 megawatts (MW), Bangkok now surpasses established markets such as Singapore, Jakarta, and Kuala Lumpur.

Thailand’s appeal rests on several structural advantages: abundant land, reliable power supply, and a favourable geopolitical position that attracts both Western and Chinese hyperscalers. Pro-data centre policies, foreign investment incentives, and advances in renewable energy continue to strengthen the market’s growth outlook.

While only a small portion of total capacity is currently operational, most projects remain in early-stage development. This imbalance reflects strong investor confidence and sustained interest in Bangkok’s long-term potential as a regional data centre hub.

A Market at an Inflection Point

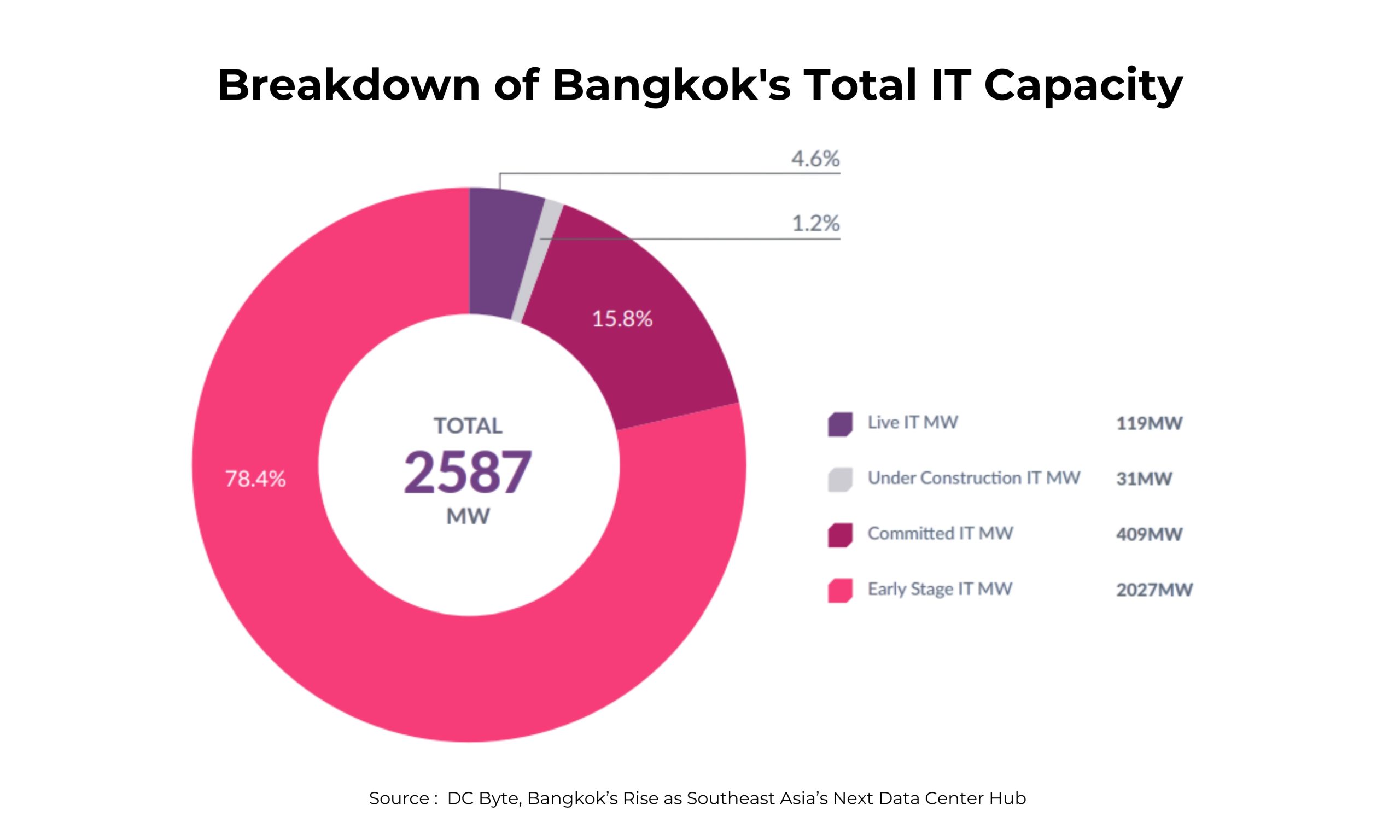

Bangkok’s data centre sector has entered a phase of accelerated growth, driven by commitments from global operators including STT GDC, GSA Data Center, Equinix, Empyrion Digital, Evolution Data Centres, DayOne, and Bridge Data Centres.

A key turning point came in 2022, when AWS announced plans to launch a cloud region in Thailand. Google followed in 2024 with plans for its first data centre in the country, reinforcing long-term confidence in Thailand’s fundamentals. Growth has been broad-based, supported by both new entrants and expansion from existing operators.

Rapid Capacity Growth and Project Execution

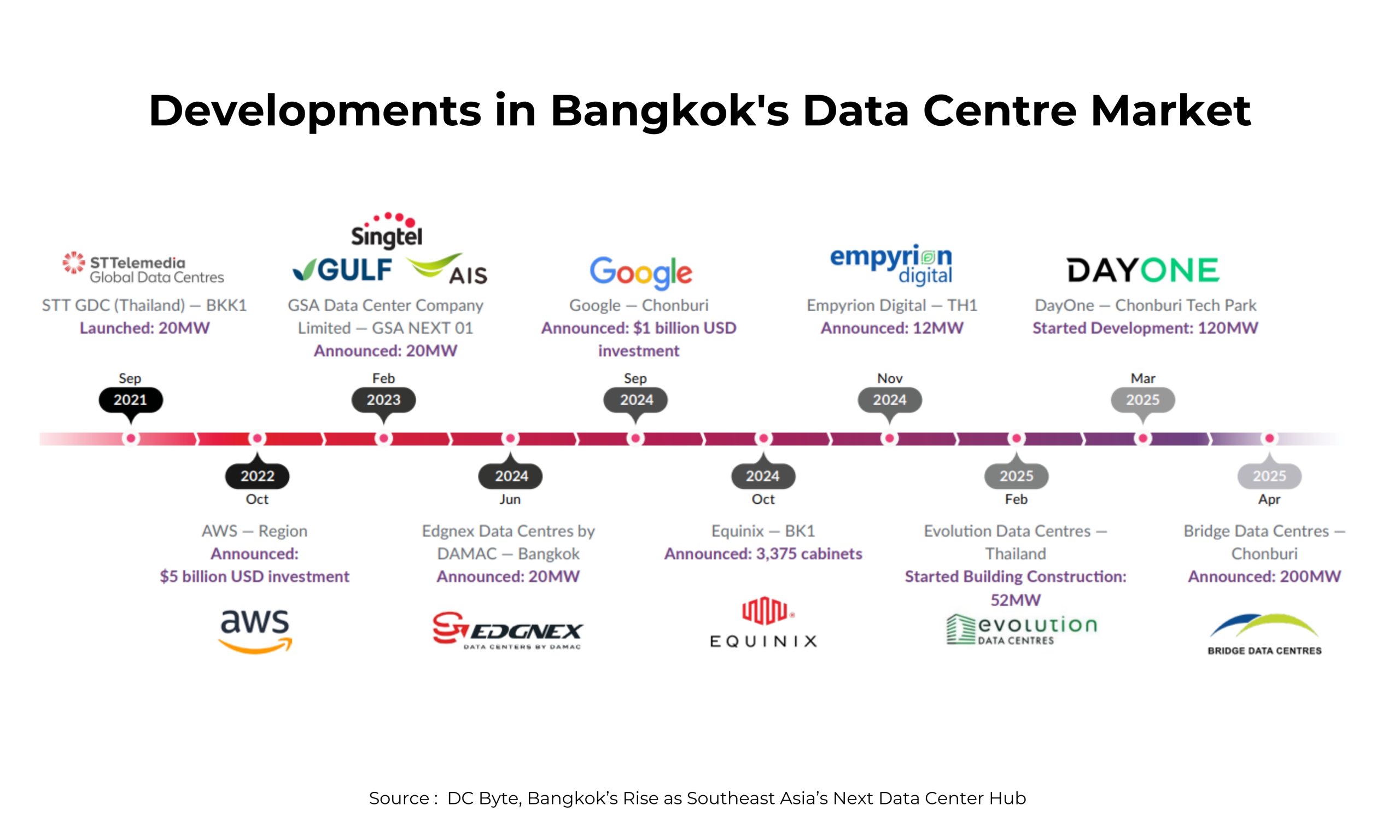

Between 2019 and 2024, Bangkok’s total IT capacity expanded more than twentyfold. Even when considering only pipeline capacity—projects under construction or committed—the market recorded a five-year CAGR of approximately 40%, demonstrating that strong demand is translating into tangible development progress.

Live capacity currently stands at around 120MW, with additional capacity expected to come online by year-end. Over the next two years, large-scale developments by Google, DayOne, and Edgnex Data Centres by DAMAC are set to significantly lift operational capacity.

Digital Investment Momentum and Cloud Demand

In 2024, Thailand’s digital investment landscape reached a new milestone. Applications for investment promotion rose 35% year-on-year, totalling USD 33 billion. The digital sector—led by data centres and cloud services—accounted for the largest share, with more than 150 projects representing USD 7.06 billion in investment.

Over the past year, cloud investments from global players such as Google and ByteDance, alongside domestic providers, have underscored rising demand for digital infrastructure and strengthened Thailand’s position as an emerging regional digital hub.

Rapid Capacity Growth and Project Execution

Between 2019 and 2024, Bangkok’s total IT capacity expanded more than twentyfold. Even when considering only pipeline capacity—projects under construction or committed—the market recorded a five-year CAGR of approximately 40%, demonstrating that strong demand is translating into tangible development progress.

Live capacity currently stands at around 120MW, with additional capacity expected to come online by year-end. Over the next two years, large-scale developments by Google, DayOne, and Edgnex Data Centres by DAMAC are set to significantly lift operational capacity.

Digital Investment Momentum and Cloud Demand

In 2024, Thailand’s digital investment landscape reached a new milestone. Applications for investment promotion rose 35% year-on-year, totalling USD 33 billion. The digital sector—led by data centres and cloud services—accounted for the largest share, with more than 150 projects representing USD 7.06 billion in investment.

Over the past year, cloud investments from global players such as Google and ByteDance, alongside domestic providers, have underscored rising demand for digital infrastructure and strengthened Thailand’s position as an emerging regional digital hub.