NEWS & EVENTS

Thailand’s real estate sales market faced significant pressure in 2025, with a nationwide transfer of only 48,095 residential units (valued at 119,663 million baht)—a decrease of 6.7% in volume and 7.8% in value from the previous year. But on the upside, the “rental property market” surprisingly surged, particularly in the Eastern Economic Corridor (EEC) region.

Increasing Market Share from Service Residences

Data from Primo Service Solution Public Company Limited reported a significant shift in rental trends. Service residences, which offer hotel-like amenities, are now gaining immense popularity. This surge is driven by international tourists from regions like Europe, Russia, China, and Korea, who increasingly opt for short-term condo rentals of one to two months instead of the typical six-month to one-year leases. This preference is largely due to the higher costs associated with hotels, a trend that is clearly allowing the service residence market to carve out a substantial market share from the hotel market.

Majority of the rental market caters to a diverse group of tenants, including tourists, Thai nationals, expatriates working in Thailand, and individuals who work on short-term industrial projects. The popular areas for these customers are in both Bangkok and its surrounding areas, along with the EEC (Eastern Economic Corridor) zone.

EEC: A Turning Point for the Rental Market Driven by Chinese Manufacturing Demand

The Eastern Economic Corridor (EEC) zone, particularly Chonburi and Rayong provinces, is experiencing a significant boost thanks to the expansion of factories and manufacturing bases from China in the EV, automotive parts, and petrochemical industries. In 2024, China was the top investor in the EEC, followed by Thailand, Singapore, Japan, and South Korea. Investment in this zone soared by an astounding 90% compared to 2023.

It’s no surprise then that demand for housing is growing in tandem to the rental demand, especially in the Bang Saen, Si Racha, and Rayong areas. These locations are rapidly becoming key hubs for high-skilled labor, industrial estate employees, and expatriates working on long-term projects.

High Returns for Service Residences in the EEC Zone

With a soaring demand for accommodation in the EEC and limited supply of hotels and apartments, many properties are consistently fully booked. This is a perfect opportunity for condos and serviced apartments to fill the gap. According to LPN, the EEC has seen a continuous launch of numerous real estate projects over the past five years. Buyers in this area include both investors and industrial estate employees earning an average of 20,000 – 50,000 baht per month, along with a growing number of Chinese investors expanding their production bases in industrial estates in Chonburi.

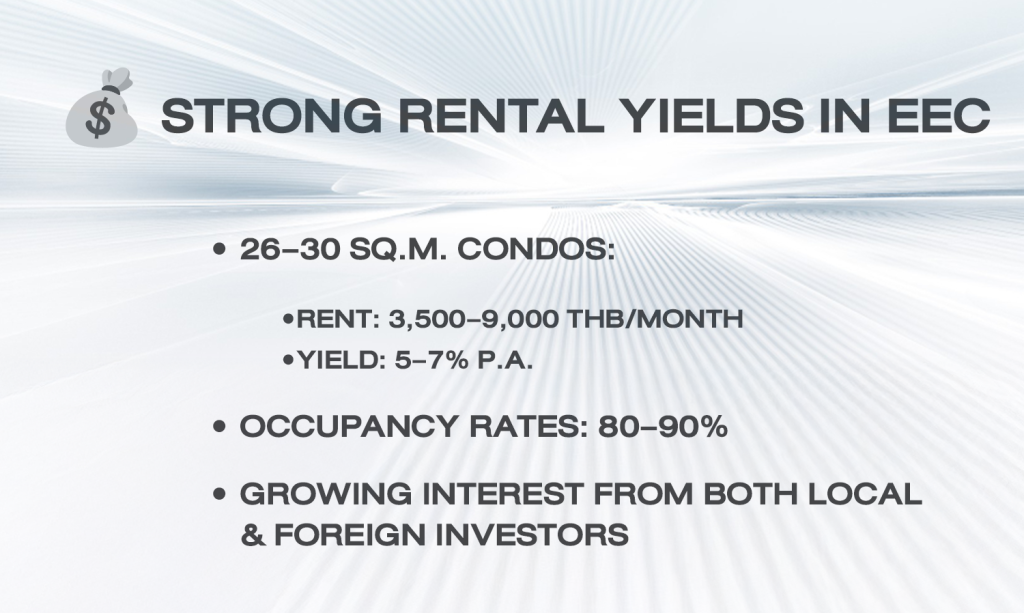

The average rental fee for a 26-30 sq.m. condo in this zone ranges from 3,500 – 9,000 baht per month with an impressive average rental yield of 5 – 7% per year. Meanwhile, the occupancy rate for apartments and serviced apartments is as high as 80 – 90%, clearly indicating high demand for accommodation in the area. It’s no wonder that both local and foreign investors are now securing properties for rental investment.

This is a golden opportunity for tenants seeking flexible, cost-effective alternatives and investors aiming for long-term income from a market with genuine demand. Rental properties in the EEC are no longer just an option; they represent a new tangible opportunity.