NEWS & EVENTS

July 2021: Brief Outlook On Southeast Asia Real Estate Market

Investments in the 21st century have turned to be a diabolical state. Yet, there are many options to start your assets with leading industries in aviation, technologies, telecommunications, properties, and more. As stated by Businesswire, “the property market is the oldest market in the world, and only now its beginning to change rapidly” by Peter Thiel, one of the leaders in the property market in Southeast Asia.

According to that particular statement, the beginning of a change in the property market has been rapid. Lately, the property market in the Southeast Asia region has gone through lots of changes and pause in the market. Pauses of new developments are to clear our unsold units in the market—changes to unsold market units for a new type of consumer behavior property market. Yet, by 2030, Southeast Asia sees itself as the fourth-largest economy globally, reported on the Business wire.

To achieve that by 2030, one giant step taken in Southeast Asia is PropertyGuru’s acquisition of all REI Group’s in Malaysia and Thailand. Plans to improve and write a new history of the property market in this region. Plans to introduce further digital educational, finance, and storytelling apps and website quick decision-making, target foreign investments, and offer support to investors to yield profit from their property assets. Leading to significant acquisitions and PropertyGuru going public will look at how Singapore, Malaysia, and Thailand property market is trending.

Singapore

a small city-state, has always attracted high net worth individuals and foreign investments year in and year out. The situation is an ongoing pandemic. In this region, Singapore has it under control. Plans to re-open the country and ease travel restrictions have been planned since last year. Singapore is planning to have a travel bubble with neighboring countries which have the pandemic under control. Plans for Singapore to re-open will start in September.

Singapore’s real estate market has always targeted high net individuals, and it plans to stay that way with PropertyGuru targeted overseas market. By targeting overseas markets yet to return, the plan uses a storytelling app for provisional buyers to see properties and calculated mortgage rates. In Singapore, foreigners can own property with low-interest rates. Singapore is a buyer’s dream to purchase property for investments, but it comes with high-income tax in Singapore. Singapore private residences target high net wealth individuals as the city-state is considered a tax haven with low wealth and property taxes. According to Strait Times, Singapore is considering imposing a wealth and property tax to taxing the wealthy to reduce inequality in the city-state. However, the plan will take some time to set as the city-state fears attracting foreign investments.

To attract foreign investors into its city-state, its branding residence properties with hotel-branded properties. Areas in Sentosa, re-branding residences properties with hotel brands increase. As reported on Singapore Tatler, hotel-branded residences bring statues, profiles, and significant resort-style housing and comfort. These hotel-branded residences, even pre-pandemic, the interest was high, and it’s going. Developers in Singapore have earned the trust of their developments by having a long-term plan in place. Targeting high net worth individuals with its hotel-branded residences creates a diverse neighborhood with low interest rates. The city-state property market seems to be upbeat with new projects and not overheated as of yet.

Thailand

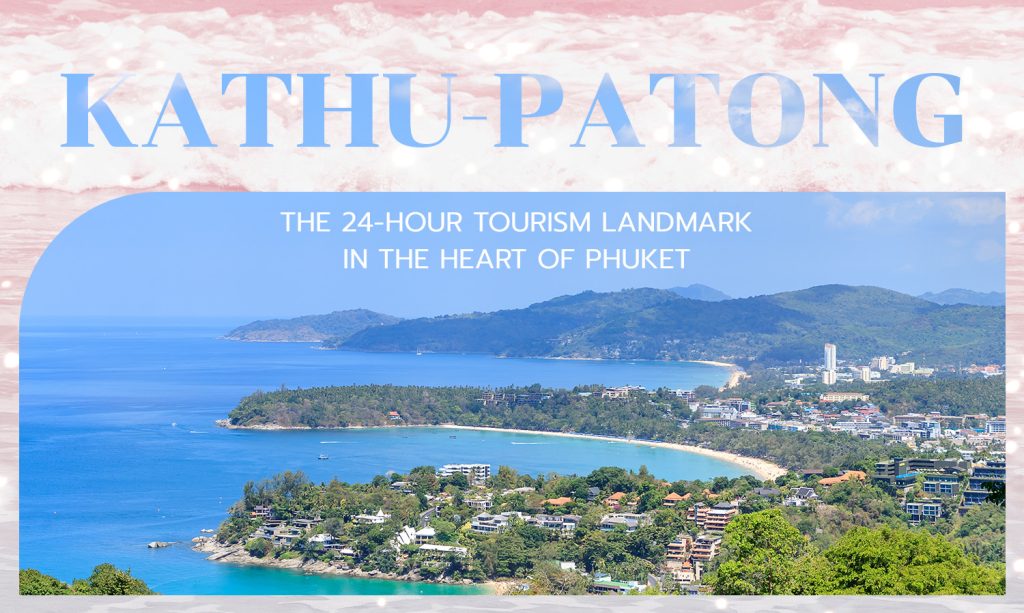

Land of Smiles, and a paradise for nomad or remote workers. The country’s real market has seen its high during the 2010s. During the ongoing pandemic, decision-making is slow, but new developments have also been happening. Focusing on the low-rise property and changing consumer behaviors wanting more space to work and families, Thailand has seen a rise in resort real estate. Foreign buyers had always been prominent in resorts purchases in the South of Thailand. However, the ongoing pandemic or fatigue has seen a change of air in the domestic market. One residential property sector has seen an uptick in resort-style living.

Domestic buyers are the main factor of the increase in the property, which consists of resorts. Local buyers are looking for ways to get out of the city as it could be by air pollutants in the capital or because of work from home. oom has become an essential work software for any industry; local buyers embrace working conditions. Local buyers are focusing more on wide-open spaces for outdoor and indoor family activities, looking for a stress-free environment to work in. Lastly, the market is trending towards less populated neighborhoods. Places in Phuket, Krabi, Koh Samui are areas where foreign buyers target resorts assets. Still, lately, Hua Hin has been a go-to place for foreign and domestic buyers to purchase property assets. Hua Hin is a private and quiet beach town near Bangkok, but still far away from the city lifestyle. This change of lifestyle and consumer behaviors for wanting more space for families and work have made Thailand’s real estate market see growth in luxury lifestyle, which is not only co, which is not only. With resort real estate purchase increasing, Thailand has plans to re-open another hot spot for investors and remote workers with the scheme to open Krabi by August 1st.

Malaysia

a country that borders the old culture of Thailand and globalization for the city-state Singapore. Foreing investments have always been high in Malaysia. Compared with Singapore, foreign buyers can own land in Malaysia. In contrast to Singapore, Malaysia attracts foreign property investors with very low-interest rates, almost non-existence, but has a reasonable high-income tax. Malaysia has been implementing models and schemes for foreign investors to call Malaysia their second home, as the project is named Malaysia My Second Home (MMSH). Like Thailand’s plans to help the economy and lure foreign investments with 10-year visas, Malaysia as a second home promotes ten-year visas. Conversely, Malaysia’s ten years visa does not have a particular group targetted.

As reported by The Edge News, the Malaysian property market expects to rebound beginning of next year because condominium prices are still flattish or stable. Malaysia is facing a similar situation as Thailand is, with changing consumer behavior and new market demand. People are taking a long time to decided whether to invest in particular property assets. There were “enthusiastic buildings in pre-pandemic Malaysia,” where developments were happening without buyers’ demand. Foreign investments have been coming in through real estate because of how open the market is to foreign investors. As now market demand had changed, with a new design and more multipurpose condominium in need now. Malaysia has plans to lift travel restrictions in October. But as Thailand is waiting to implement a new lure to slur up the economy and real estate market, Malaysia is preparing you to have a second home in Malaysia. As the country market is near a beachfront with lovely scenery, experts have described the real estate market as a buy and hold market to yield profits in 3-5 years.

Nevertheless, as the ongoing pandemic has affected the country. One time is specified as the property market is one of the oldest markets to invest in, but it has changed rapidly. In Southeast Asia, it sees itself as a giant digital and technology front in the world by 2030. Therefore, foreign investors would be interested in visiting Southeast Asia property as a buyer-friendly market, with various designs and property types to choose from. Notably, the property market in the region is a buy-and-hold need to yield profits and assets soon.